Full Monthly Payment

Interest Only

Months

Total Interest Payable

Total Loan Payments

Total Cost

| Year | Interest Paid | Capital Paid | Mortgage Balance |

|---|---|---|---|

| 1 | £7,641.85 | £4,108.13 | £175,891.87 |

| 2 | £7,462.10 | £4,287.87 | £171,604.00 |

| 3 | £7,274.49 | £4,475.48 | £167,128.52 |

| 4 | £7,078.67 | £4,671.30 | £162,457.22 |

| 5 | £6,874.29 | £4,875.69 | £157,581.54 |

| 6 | £6,660.96 | £5,089.02 | £152,492.52 |

| 7 | £6,438.30 | £5,311.68 | £147,180.84 |

| 8 | £6,205.89 | £5,544.08 | £141,636.76 |

| 9 | £5,963.32 | £5,786.66 | £135,850.10 |

| 10 | £5,710.13 | £6,039.85 | £129,810.25 |

| 11 | £5,445.86 | £6,304.11 | £123,506.14 |

| 12 | £5,170.04 | £6,579.94 | £116,926.21 |

| 13 | £4,882.14 | £6,867.83 | £110,058.37 |

| 14 | £4,581.65 | £7,168.33 | £102,890.04 |

| 15 | £4,268.01 | £7,481.97 | £95,408.07 |

| 16 | £3,940.64 | £7,809.33 | £87,598.74 |

| 17 | £3,598.96 | £8,151.02 | £79,447.72 |

| 18 | £3,242.32 | £8,507.66 | £70,940.07 |

| 19 | £2,870.08 | £8,879.90 | £62,060.17 |

| 20 | £2,481.55 | £9,268.42 | £52,791.75 |

| 21 | £2,076.02 | £9,673.95 | £43,117.80 |

| 22 | £1,652.75 | £10,097.22 | £33,020.57 |

| 23 | £1,210.96 | £10,539.01 | £22,481.56 |

| 24 | £749.84 | £11,000.13 | £11,481.43 |

| 25 | £268.55 | £11,481.43 | £0.00 |

| Month | Interest Paid | Capital Paid | Mortgage Balance |

|---|---|---|---|

| 1 | £643.50 | £335.66 | £179,664.34 |

| 2 | £642.30 | £336.86 | £179,327.47 |

| 3 | £641.10 | £338.07 | £178,989.40 |

| 4 | £639.89 | £339.28 | £178,650.12 |

| 5 | £638.67 | £340.49 | £178,309.63 |

| 6 | £637.46 | £341.71 | £177,967.93 |

| 7 | £636.24 | £342.93 | £177,625.00 |

| 8 | £635.01 | £344.16 | £177,280.84 |

| 9 | £633.78 | £345.39 | £176,935.46 |

| 10 | £632.54 | £346.62 | £176,588.84 |

| 11 | £631.31 | £347.86 | £176,240.98 |

| 12 | £630.06 | £349.10 | £175,891.87 |

| 13 | £628.81 | £350.35 | £175,541.52 |

| 14 | £627.56 | £351.60 | £175,189.92 |

| 15 | £626.30 | £352.86 | £174,837.06 |

| 16 | £625.04 | £354.12 | £174,482.94 |

| 17 | £623.78 | £355.39 | £174,127.55 |

| 18 | £622.51 | £356.66 | £173,770.89 |

| 19 | £621.23 | £357.93 | £173,412.96 |

| 20 | £619.95 | £359.21 | £173,053.74 |

| 21 | £618.67 | £360.50 | £172,693.25 |

| 22 | £617.38 | £361.79 | £172,331.46 |

| 23 | £616.08 | £363.08 | £171,968.38 |

| 24 | £614.79 | £364.38 | £171,604.00 |

| 25 | £613.48 | £365.68 | £171,238.32 |

| 26 | £612.18 | £366.99 | £170,871.34 |

| 27 | £610.87 | £368.30 | £170,503.04 |

| 28 | £609.55 | £369.62 | £170,133.42 |

| 29 | £608.23 | £370.94 | £169,762.48 |

| 30 | £606.90 | £372.26 | £169,390.22 |

| 31 | £605.57 | £373.59 | £169,016.62 |

| 32 | £604.23 | £374.93 | £168,641.69 |

| 33 | £602.89 | £376.27 | £168,265.42 |

| 34 | £601.55 | £377.62 | £167,887.81 |

| 35 | £600.20 | £378.97 | £167,508.84 |

| 36 | £598.84 | £380.32 | £167,128.52 |

| 37 | £597.48 | £381.68 | £166,746.84 |

| 38 | £596.12 | £383.04 | £166,363.80 |

| 39 | £594.75 | £384.41 | £165,979.38 |

| 40 | £593.38 | £385.79 | £165,593.59 |

| 41 | £592.00 | £387.17 | £165,206.43 |

| 42 | £590.61 | £388.55 | £164,817.88 |

| 43 | £589.22 | £389.94 | £164,427.94 |

| 44 | £587.83 | £391.33 | £164,036.60 |

| 45 | £586.43 | £392.73 | £163,643.87 |

| 46 | £585.03 | £394.14 | £163,249.73 |

| 47 | £583.62 | £395.55 | £162,854.18 |

| 48 | £582.20 | £396.96 | £162,457.22 |

| 49 | £580.78 | £398.38 | £162,058.84 |

| 50 | £579.36 | £399.80 | £161,659.04 |

| 51 | £577.93 | £401.23 | £161,257.80 |

| 52 | £576.50 | £402.67 | £160,855.14 |

| 53 | £575.06 | £404.11 | £160,451.03 |

| 54 | £573.61 | £405.55 | £160,045.48 |

| 55 | £572.16 | £407.00 | £159,638.47 |

| 56 | £570.71 | £408.46 | £159,230.02 |

| 57 | £569.25 | £409.92 | £158,820.10 |

| 58 | £567.78 | £411.38 | £158,408.72 |

| 59 | £566.31 | £412.85 | £157,995.86 |

| 60 | £564.84 | £414.33 | £157,581.54 |

| 61 | £563.35 | £415.81 | £157,165.72 |

| 62 | £561.87 | £417.30 | £156,748.43 |

| 63 | £560.38 | £418.79 | £156,329.64 |

| 64 | £558.88 | £420.29 | £155,909.35 |

| 65 | £557.38 | £421.79 | £155,487.56 |

| 66 | £555.87 | £423.30 | £155,064.27 |

| 67 | £554.35 | £424.81 | £154,639.46 |

| 68 | £552.84 | £426.33 | £154,213.13 |

| 69 | £551.31 | £427.85 | £153,785.28 |

| 70 | £549.78 | £429.38 | £153,355.89 |

| 71 | £548.25 | £430.92 | £152,924.98 |

| 72 | £546.71 | £432.46 | £152,492.52 |

| 73 | £545.16 | £434.00 | £152,058.52 |

| 74 | £543.61 | £435.56 | £151,622.96 |

| 75 | £542.05 | £437.11 | £151,185.85 |

| 76 | £540.49 | £438.68 | £150,747.17 |

| 77 | £538.92 | £440.24 | £150,306.93 |

| 78 | £537.35 | £441.82 | £149,865.11 |

| 79 | £535.77 | £443.40 | £149,421.72 |

| 80 | £534.18 | £444.98 | £148,976.73 |

| 81 | £532.59 | £446.57 | £148,530.16 |

| 82 | £531.00 | £448.17 | £148,081.99 |

| 83 | £529.39 | £449.77 | £147,632.22 |

| 84 | £527.79 | £451.38 | £147,180.84 |

| 85 | £526.17 | £452.99 | £146,727.85 |

| 86 | £524.55 | £454.61 | £146,273.24 |

| 87 | £522.93 | £456.24 | £145,817.00 |

| 88 | £521.30 | £457.87 | £145,359.13 |

| 89 | £519.66 | £459.51 | £144,899.62 |

| 90 | £518.02 | £461.15 | £144,438.48 |

| 91 | £516.37 | £462.80 | £143,975.68 |

| 92 | £514.71 | £464.45 | £143,511.23 |

| 93 | £513.05 | £466.11 | £143,045.11 |

| 94 | £511.39 | £467.78 | £142,577.34 |

| 95 | £509.71 | £469.45 | £142,107.89 |

| 96 | £508.04 | £471.13 | £141,636.76 |

| 97 | £506.35 | £472.81 | £141,163.94 |

| 98 | £504.66 | £474.50 | £140,689.44 |

| 99 | £502.96 | £476.20 | £140,213.24 |

| 100 | £501.26 | £477.90 | £139,735.34 |

| 101 | £499.55 | £479.61 | £139,255.73 |

| 102 | £497.84 | £481.33 | £138,774.40 |

| 103 | £496.12 | £483.05 | £138,291.36 |

| 104 | £494.39 | £484.77 | £137,806.58 |

| 105 | £492.66 | £486.51 | £137,320.08 |

| 106 | £490.92 | £488.25 | £136,831.83 |

| 107 | £489.17 | £489.99 | £136,341.84 |

| 108 | £487.42 | £491.74 | £135,850.10 |

| 109 | £485.66 | £493.50 | £135,356.60 |

| 110 | £483.90 | £495.26 | £134,861.33 |

| 111 | £482.13 | £497.04 | £134,364.30 |

| 112 | £480.35 | £498.81 | £133,865.49 |

| 113 | £478.57 | £500.60 | £133,364.89 |

| 114 | £476.78 | £502.39 | £132,862.51 |

| 115 | £474.98 | £504.18 | £132,358.33 |

| 116 | £473.18 | £505.98 | £131,852.34 |

| 117 | £471.37 | £507.79 | £131,344.55 |

| 118 | £469.56 | £509.61 | £130,834.94 |

| 119 | £467.73 | £511.43 | £130,323.51 |

| 120 | £465.91 | £513.26 | £129,810.25 |

| 121 | £464.07 | £515.09 | £129,295.16 |

| 122 | £462.23 | £516.93 | £128,778.23 |

| 123 | £460.38 | £518.78 | £128,259.44 |

| 124 | £458.53 | £520.64 | £127,738.81 |

| 125 | £456.67 | £522.50 | £127,216.31 |

| 126 | £454.80 | £524.37 | £126,691.94 |

| 127 | £452.92 | £526.24 | £126,165.70 |

| 128 | £451.04 | £528.12 | £125,637.58 |

| 129 | £449.15 | £530.01 | £125,107.57 |

| 130 | £447.26 | £531.90 | £124,575.67 |

| 131 | £445.36 | £533.81 | £124,041.86 |

| 132 | £443.45 | £535.71 | £123,506.14 |

| 133 | £441.53 | £537.63 | £122,968.51 |

| 134 | £439.61 | £539.55 | £122,428.96 |

| 135 | £437.68 | £541.48 | £121,887.48 |

| 136 | £435.75 | £543.42 | £121,344.06 |

| 137 | £433.81 | £545.36 | £120,798.70 |

| 138 | £431.86 | £547.31 | £120,251.40 |

| 139 | £429.90 | £549.27 | £119,702.13 |

| 140 | £427.94 | £551.23 | £119,150.90 |

| 141 | £425.96 | £553.20 | £118,597.70 |

| 142 | £423.99 | £555.18 | £118,042.52 |

| 143 | £422.00 | £557.16 | £117,485.36 |

| 144 | £420.01 | £559.15 | £116,926.21 |

| 145 | £418.01 | £561.15 | £116,365.05 |

| 146 | £416.01 | £563.16 | £115,801.89 |

| 147 | £413.99 | £565.17 | £115,236.72 |

| 148 | £411.97 | £567.19 | £114,669.53 |

| 149 | £409.94 | £569.22 | £114,100.31 |

| 150 | £407.91 | £571.26 | £113,529.05 |

| 151 | £405.87 | £573.30 | £112,955.75 |

| 152 | £403.82 | £575.35 | £112,380.40 |

| 153 | £401.76 | £577.40 | £111,803.00 |

| 154 | £399.70 | £579.47 | £111,223.53 |

| 155 | £397.62 | £581.54 | £110,641.99 |

| 156 | £395.55 | £583.62 | £110,058.37 |

| 157 | £393.46 | £585.71 | £109,472.66 |

| 158 | £391.36 | £587.80 | £108,884.86 |

| 159 | £389.26 | £589.90 | £108,294.96 |

| 160 | £387.15 | £592.01 | £107,702.95 |

| 161 | £385.04 | £594.13 | £107,108.83 |

| 162 | £382.91 | £596.25 | £106,512.58 |

| 163 | £380.78 | £598.38 | £105,914.19 |

| 164 | £378.64 | £600.52 | £105,313.67 |

| 165 | £376.50 | £602.67 | £104,711.01 |

| 166 | £374.34 | £604.82 | £104,106.18 |

| 167 | £372.18 | £606.98 | £103,499.20 |

| 168 | £370.01 | £609.15 | £102,890.04 |

| 169 | £367.83 | £611.33 | £102,278.71 |

| 170 | £365.65 | £613.52 | £101,665.19 |

| 171 | £363.45 | £615.71 | £101,049.48 |

| 172 | £361.25 | £617.91 | £100,431.57 |

| 173 | £359.04 | £620.12 | £99,811.45 |

| 174 | £356.83 | £622.34 | £99,189.11 |

| 175 | £354.60 | £624.56 | £98,564.54 |

| 176 | £352.37 | £626.80 | £97,937.75 |

| 177 | £350.13 | £629.04 | £97,308.71 |

| 178 | £347.88 | £631.29 | £96,677.43 |

| 179 | £345.62 | £633.54 | £96,043.88 |

| 180 | £343.36 | £635.81 | £95,408.07 |

| 181 | £341.08 | £638.08 | £94,769.99 |

| 182 | £338.80 | £640.36 | £94,129.63 |

| 183 | £336.51 | £642.65 | £93,486.98 |

| 184 | £334.22 | £644.95 | £92,842.03 |

| 185 | £331.91 | £647.25 | £92,194.78 |

| 186 | £329.60 | £649.57 | £91,545.21 |

| 187 | £327.27 | £651.89 | £90,893.32 |

| 188 | £324.94 | £654.22 | £90,239.10 |

| 189 | £322.60 | £656.56 | £89,582.54 |

| 190 | £320.26 | £658.91 | £88,923.63 |

| 191 | £317.90 | £661.26 | £88,262.37 |

| 192 | £315.54 | £663.63 | £87,598.74 |

| 193 | £313.17 | £666.00 | £86,932.74 |

| 194 | £310.78 | £668.38 | £86,264.36 |

| 195 | £308.40 | £670.77 | £85,593.59 |

| 196 | £306.00 | £673.17 | £84,920.43 |

| 197 | £303.59 | £675.57 | £84,244.85 |

| 198 | £301.18 | £677.99 | £83,566.86 |

| 199 | £298.75 | £680.41 | £82,886.45 |

| 200 | £296.32 | £682.85 | £82,203.61 |

| 201 | £293.88 | £685.29 | £81,518.32 |

| 202 | £291.43 | £687.74 | £80,830.58 |

| 203 | £288.97 | £690.20 | £80,140.39 |

| 204 | £286.50 | £692.66 | £79,447.72 |

| 205 | £284.03 | £695.14 | £78,752.59 |

| 206 | £281.54 | £697.62 | £78,054.96 |

| 207 | £279.05 | £700.12 | £77,354.84 |

| 208 | £276.54 | £702.62 | £76,652.22 |

| 209 | £274.03 | £705.13 | £75,947.09 |

| 210 | £271.51 | £707.65 | £75,239.44 |

| 211 | £268.98 | £710.18 | £74,529.25 |

| 212 | £266.44 | £712.72 | £73,816.53 |

| 213 | £263.89 | £715.27 | £73,101.26 |

| 214 | £261.34 | £717.83 | £72,383.43 |

| 215 | £258.77 | £720.39 | £71,663.04 |

| 216 | £256.20 | £722.97 | £70,940.07 |

| 217 | £253.61 | £725.55 | £70,214.52 |

| 218 | £251.02 | £728.15 | £69,486.37 |

| 219 | £248.41 | £730.75 | £68,755.62 |

| 220 | £245.80 | £733.36 | £68,022.25 |

| 221 | £243.18 | £735.98 | £67,286.27 |

| 222 | £240.55 | £738.62 | £66,547.65 |

| 223 | £237.91 | £741.26 | £65,806.40 |

| 224 | £235.26 | £743.91 | £65,062.49 |

| 225 | £232.60 | £746.57 | £64,315.92 |

| 226 | £229.93 | £749.24 | £63,566.69 |

| 227 | £227.25 | £751.91 | £62,814.77 |

| 228 | £224.56 | £754.60 | £62,060.17 |

| 229 | £221.87 | £757.30 | £61,302.87 |

| 230 | £219.16 | £760.01 | £60,542.87 |

| 231 | £216.44 | £762.72 | £59,780.14 |

| 232 | £213.71 | £765.45 | £59,014.69 |

| 233 | £210.98 | £768.19 | £58,246.51 |

| 234 | £208.23 | £770.93 | £57,475.57 |

| 235 | £205.48 | £773.69 | £56,701.88 |

| 236 | £202.71 | £776.46 | £55,925.43 |

| 237 | £199.93 | £779.23 | £55,146.20 |

| 238 | £197.15 | £782.02 | £54,364.18 |

| 239 | £194.35 | £784.81 | £53,579.37 |

| 240 | £191.55 | £787.62 | £52,791.75 |

| 241 | £188.73 | £790.43 | £52,001.31 |

| 242 | £185.90 | £793.26 | £51,208.06 |

| 243 | £183.07 | £796.10 | £50,411.96 |

| 244 | £180.22 | £798.94 | £49,613.02 |

| 245 | £177.37 | £801.80 | £48,811.22 |

| 246 | £174.50 | £804.66 | £48,006.56 |

| 247 | £171.62 | £807.54 | £47,199.01 |

| 248 | £168.74 | £810.43 | £46,388.59 |

| 249 | £165.84 | £813.33 | £45,575.26 |

| 250 | £162.93 | £816.23 | £44,759.03 |

| 251 | £160.01 | £819.15 | £43,939.88 |

| 252 | £157.09 | £822.08 | £43,117.80 |

| 253 | £154.15 | £825.02 | £42,292.78 |

| 254 | £151.20 | £827.97 | £41,464.81 |

| 255 | £148.24 | £830.93 | £40,633.88 |

| 256 | £145.27 | £833.90 | £39,799.98 |

| 257 | £142.28 | £836.88 | £38,963.11 |

| 258 | £139.29 | £839.87 | £38,123.23 |

| 259 | £136.29 | £842.87 | £37,280.36 |

| 260 | £133.28 | £845.89 | £36,434.47 |

| 261 | £130.25 | £848.91 | £35,585.56 |

| 262 | £127.22 | £851.95 | £34,733.62 |

| 263 | £124.17 | £854.99 | £33,878.62 |

| 264 | £121.12 | £858.05 | £33,020.57 |

| 265 | £118.05 | £861.12 | £32,159.46 |

| 266 | £114.97 | £864.19 | £31,295.26 |

| 267 | £111.88 | £867.28 | £30,427.98 |

| 268 | £108.78 | £870.38 | £29,557.60 |

| 269 | £105.67 | £873.50 | £28,684.10 |

| 270 | £102.55 | £876.62 | £27,807.48 |

| 271 | £99.41 | £879.75 | £26,927.73 |

| 272 | £96.27 | £882.90 | £26,044.83 |

| 273 | £93.11 | £886.05 | £25,158.78 |

| 274 | £89.94 | £889.22 | £24,269.55 |

| 275 | £86.76 | £892.40 | £23,377.15 |

| 276 | £83.57 | £895.59 | £22,481.56 |

| 277 | £80.37 | £898.79 | £21,582.77 |

| 278 | £77.16 | £902.01 | £20,680.76 |

| 279 | £73.93 | £905.23 | £19,775.53 |

| 280 | £70.70 | £908.47 | £18,867.07 |

| 281 | £67.45 | £911.71 | £17,955.35 |

| 282 | £64.19 | £914.97 | £17,040.38 |

| 283 | £60.92 | £918.25 | £16,122.13 |

| 284 | £57.64 | £921.53 | £15,200.60 |

| 285 | £54.34 | £924.82 | £14,275.78 |

| 286 | £51.04 | £928.13 | £13,347.65 |

| 287 | £47.72 | £931.45 | £12,416.21 |

| 288 | £44.39 | £934.78 | £11,481.43 |

| 289 | £41.05 | £938.12 | £10,543.31 |

| 290 | £37.69 | £941.47 | £9,601.84 |

| 291 | £34.33 | £944.84 | £8,657.00 |

| 292 | £30.95 | £948.22 | £7,708.78 |

| 293 | £27.56 | £951.61 | £6,757.18 |

| 294 | £24.16 | £955.01 | £5,802.17 |

| 295 | £20.74 | £958.42 | £4,843.75 |

| 296 | £17.32 | £961.85 | £3,881.90 |

| 297 | £13.88 | £965.29 | £2,916.61 |

| 298 | £10.43 | £968.74 | £1,947.88 |

| 299 | £6.96 | £972.20 | £975.68 |

| 300 | £3.49 | £975.68 | £0.00 |

Understanding How Remortgaging Works

You might have heard about remortgaging at some point in time. But what is it, exactly? Remortgaging is the process of switching to a new mortgage to pay off your original home loan. For the most part, borrowers remortgage to secure a better rate and keep their monthly payments affordable.

When purchasing a home, many buyers typically start off with an introductory mortgage rate. This can last for 2 to 5 years, depending on the type of mortgage you choose. Once the introductory period ends, your mortgage reverts to the standard variable rate (SVR) mortgage. SVRs usually come with a higher interest rate than other loan options. To avoid this, homeowners remortgage to obtain a more favourable deal.

Our article will explain how the remortgaging process works and the requirements you need. We’ll discuss different reasons why borrowers choose to remortgage, including its benefits and challenges. We’ll talk about when it’s a good idea to remortgage, and when remortgaging may be unfavourable. Understanding how this process works should help you make informed decisions before taking a new mortgage deal.

What is Remortgaging?

Remortgaging is paying off your existing mortgage by taking out a new mortgage deal using the same property as security. When a borrower remortgages, it allows them to obtain a more favourable interest rate, change their payment term, or both. If you secure a low enough rate, it’s possible to reduce monthly payments after remortgaging. In the United States, the process of remortgaging is commonly referred to as refinancing.

Often, borrowers remortgage their loan to secure a lower rate from a different lender. With a reduced rate, homeowners can make more affordable monthly payments to maximise their interest savings. You can also remortgage to pay off your home earlier, consolidate debt, or raise capital upon releasing equity from the remortgage.

When an introductory rate expires, a vast majority of borrowers remortgage their loan. They do so to keep their loan from reverting to the standard variable rate (SVR), which usually comes with a higher rate. In recent years, many homebuyers in the UK have been taking fixed-rate mortgages.

According to the Bank of England, majority of borrowers have been choosing fixed-rate mortgages since 2016, especially first-time homebuyers. Once their mortgage deal ends, homeowners commonly remortgage to secure a fixed-rate deal or another option with a rate lower than the SVR.

As of March 15, 2021, the following table compares interest rates between SVR, fixed-rate, and tracker mortgages. This is based on an 85% loan-to-value ratio (LTV) with a maximum loan amount of £500,000 from HSBC UK. Notice how the SVR has the highest interest rate compared to other types of loans.

| Type of Mortgage | Interest Rate |

|---|---|

| SVR | 3.54% |

| 2-year Fixed | 2.54% |

| 5-year Fixed | 2.84% |

| 2-year Tracker | 2.99% |

When is the best time to remortgage? Often, the right time to remortgage is when your tie-in period with your existing deal ends. This way, you can avoid paying early repayment charges. More importantly, you’ll be able to avoid reverting to your lender’s standard variable rate, which is usually higher.

How does remortgaging compare to an original mortgage? The aim of remortgaging is to secure a better deal than your lender’s SVR reversion rate when the introductory period expires. For instance, you purchased a house with an introductory 5-year fixed rate at 2.69% APR. After that five-year period, if you do not remortgage, your loan will automatically revert to the lender’s standard SVR. This will likely be higher than your original rate.

Thus, remortgaging allows you to maintain a low interest rate for the next couple of years. Just be sure to find deal with an affordable interest rate. The fixed rate will keep your monthly payments predictable. And since your payments remain the same for the agreed term, you can avoid increasing monthly payments. In contrast, SVR mortgage rates rise and fall based on the general economy and the Bank of England base rate. Once SVR rates increase, you must be ready with higher monthly payments.

If you remortgage into a fixed-rate deal, you have the option to choose from different terms. This can be as short as two years or five years, or even up to ten years. Note that a shorter fixed-rate term has a lower rate, while a longer ten-year term has a slightly higher rate. Extended fixed rates provide borrowers with more payment stability, which is why lenders charge a higher rate.

More Favourable Remortgaging Deals with Lower LTV

Besides your credit score, mortgage rates are also based on your loan-to-value ratio (LTV). This percentage represents the value of the property compared to the amount you want to borrow. For example, you purchased a £100,000 property with £80,000 mortgage. This results in 80% LTV.

A lower LTV ratio means you’ve paid a high down payment. If you’ve been paying your mortgage for several years, it means you’ve gained significant equity on your home. Lenders typically offer lower rates to borrowers with lower LTV. Thus, if you substantially reduce your LTV when you remortgage, you are eligible for a more favourable interest rate.

The following example shows interest rates for 5-year fixed standard mortgages with corresponding LTV ratios as of March 15, 2021 from HSBC UK.

| LTV Ratio | 5-year Fixed Standard Rates | Maximum Loan Amount |

|---|---|---|

| 90% | 3.39% | £400,000 |

| 85% | 2.84% | £500,000 |

| 80% | 2.24% | £1,000,000 |

| 75% | 1.69% | £2,000,000 |

| 70% | 1.69% | £3,000,000 |

| 60% | 1.34% | £5,000,000 |

Based on the table, borrowers with 90% LTV receive the highest rate at 3.39% APR, for a maximum loan amount of £400,000. As the LTV ratio decreases, you’ll notice the corresponding interest rate is reduced, while the loan amount increases. At 80% LTV, a borrower receives a lower interest rate of 2.24% APR, for a maximum loan amount of £1,000,000. If you remortgage with 60% LTV, you’re eligible for a maximum loan amount of £5,000,000 at 1.34% APR.

Basically, the lower your LTV, the more favourable remortgage deals will be available to you.

According to the Financial Conduct Authority (FCA), by the end of Q4 in 2020, the total value of all residential mortgages in the UK was £1,541.4 billion. That’s 2.9% higher than Q4 of 2019. Meanwhile, gross mortgage advances in Q4 of 2020 amounted to £76.6 billion, which was 4.2% higher than Q4 of 2019.

Over the past 3 years, remortgaging has comprised between 27.49% to 37.83% of the UK market, with the peak coming in Q2 of 2020 after interest rates fell in response to the COVID-19 crisis. By Q4 of 2020, 18.45% of residential loans to individuals were remortgages.

As for new mortgage commitments, which is lending agreed to be advanced in the coming months, the value was £87.7 billion in Q4 of 2020. This was 24.2% higher than the previous year, which was also the highest level recorded since Q3 of 2007.

Percentage of Remortgaging Borrowers

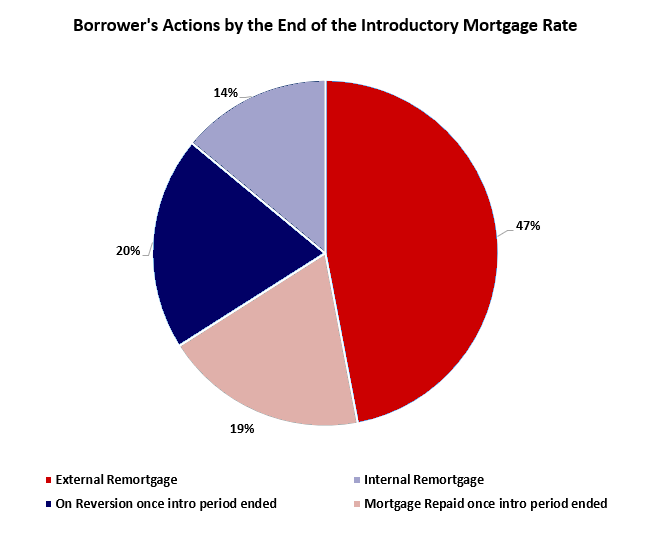

In the FCA’s 2016 study, a large percentage of borrowers were considered attentive by the time their introductory mortgage ended. In a study of new borrowers, researchers found that 66% of homeowners remortgaged their loan. They either got a new deal with their current lender (47%) or a new deal with a different lender (19%). Most of these borrowers anticipated the rate change well in advance. They actively searched for ways to maintain their rate to avoid expensive monthly payments.

Meanwhile, around 14% repaid their mortgage, most likely by selling their home. Lastly, the remaining 20% did not remortgage once the introductory period ended. These borrowers ended up with their lender’s reversion rate, which is the higher SVR rate. The study also notes that those who do not remortgage tend to have slightly lower incomes than borrowers with higher incomes.

Data from the FCA Insight analysis site.

To clarify, lower remortgaging tendencies for low-income borrowers is not caused by lack of mortgage availability. It has more to do with time and management constraints. When a home loan is under the name of a single borrower, people are less likely to remortgage. On the other hand, data suggests it’s easier to remortgage when two people in a household apply for a mortgage. Besides more income, two people can devote more time and effort required to apply for remortgaging. Older borrowers over the age of 50 are also less likely to remortgage than younger borrowers.

Furthermore, borrowers who used a mortgage broker to obtain their initial mortgage are more likely to remortgage. This is in contrast to those who directly obtained mortgages from a lender. The data suggests that brokers help influence homeowner’s remortgaging decisions once their introductory mortgage expires.

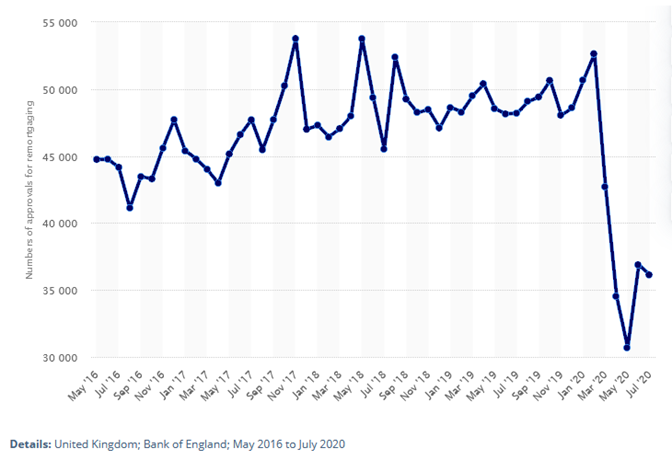

Data from the Bank of England shows the number of approvals for remortgages in the UK. This included approved remortgages between May 2016 to July 2020. The trend shows that remortgaging statistics have been fluctuating since 2016. In February 2020, remortgaging approvals were at 52.6 thousand. However, after just three months, it drastically declined to 30.69 thousand in May 2020. See the trend below:

The huge drop in remortgage approvals is attributed to the impact of the 2020 COVID-19 crisis. Even new mortgage approvals decreased, with just 9,300 new UK loans approved in May 2020. The months of April and May 2020 were challenging for all sectors of the economy, as social distancing measures forced many industries to work from home. To stimulate market activity and encourage growth, the Bank of England reduced its base rate to 0.1% as early as March 19, 2020. It’s the lowest base rate in the Bank’s 325-year history.

According to Nick Chadbourne, CEO of Legal Marketing Service (LMS), the remortgage market remained strong. It outperformed many other areas as borrowers rushed to take advantage of record-low interest rates. Lower interest rates also created more competitive product choices for both purchasing and remortgaging loans. Overall, the reduced rate has helped the housing market stay afloat in 2020.

When we came out of lockdown in May (2020), the housing market boomed. House prices rose, and continued to rise, so much so that recent figures claim homeowners have made more money on their property in the past 10 months than they did in the three-and-a-half years prior.

The government also encouraged market activity by raising the Stamp Duty Tax threshold from £125,000 to £500,000 until March 31, 2021. Stamp Duty holiday gave many prospective homebuyers a temporary tax break. This encouraged more people to purchase homes. Later in March 2021, Chancellor Rishi Sunak announced that Stamp Duty holiday was extended until June 30, 2021.

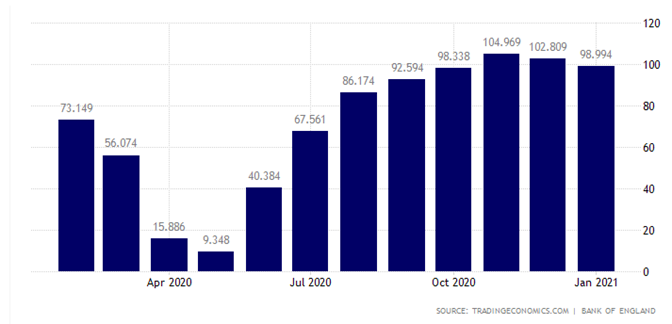

The following graph shows UK mortgage approval levels between February 2020 to January 2021. Notice how mortgage approvals drastically increased from 9.3 thousand in May 2020, to 104.9 thousand in November 2020. This eventually decreased to 98.9 thousand by January 2021.

By 2021, remortgaging activity has gradually tapered off as the home purchase market boomed. Mortgage approvals increased toward November 2020, but also decreased come January 2021. Chadbourne notes the decrease should not be a cause for alarm. Mortgage approvals are beginning to rebuild as lenders regain their confidence once more. After the boom, when normal mortgage demand resumes, the housing industry should be ready to process applications at its usual levels.

Things to Consider Before Remortgaging

While remortgaging has its benefits, specifically more favourable rates, you must assess your financial situation. It entails certain costs you might not be ready for. Shopping for rates and looking for a new lender will also take time. Like a traditional mortgage, expect lenders to make the necessary credit checks before approving your application. You must prove you can afford the mortgage with the new terms. Here are several questions to ponder before remortgaging:

1

Do you need to pay early repayment fees? Early repayment charges (ERC) are required if you remortgage before your current deal ends. This costs between 2% to 5% of your outstanding loan. Generally, remortgaging early is discouraged because of this additional cost. But if you time your remortgage at least three months before your original deal ends, you can secure a new one when your current mortgage expires. If you must remortgage early, assess if the early repayment fees are worth it. But ideally, you should avoid early payment fees at all costs.

2

Do you have a good credit score? Just like a new mortgage, lenders check your credit score when you apply for a remortgage. It pays to have a good credit record showing on-time payments and low credit card balances. According to Equifax, lenders normally do not publish criteria for remortgage approvals. But it’s best to improve your credit score before applying for a remortgage or any type of loan.

3

Have I reviewed my credit report? Be sure to check your credit report before you submit your application. Any mistake in your credit record, such as incorrect payment information, the wrong name, or inaccurate address can negatively impact your credit score. To correct your credit information, you may dispute errors to your credit reference agency.

4

Can I remortgage with a poor credit score? It’s possible to remortgage even with bad credit. There are lenders that service borrowers with less-than-pristine credit ratings. However, note that the best deals are only available to higher credit score borrowers. Lenders normally charge a higher interest rate if you have a low credit score. This offsets the default risk you present. But as a rule of thumb, give yourself time to increase your credit score before remortgaging or applying for any loan.

5

When should I start shopping for remortgaging rates? You can start researching and comparing rates at least three months before your original mortgage ends. Give yourself enough time to weigh in your options and compare costs between prospective mortgage deals.

Why Do Borrowers Remortgage?

For the most part, people want to remortgage to save money. Sometimes, they may also want to borrow money from the equity they’ve built on their home. Here are specific reasons why borrowers choose to remortgage:

Your current mortgage deal is about to end.

The most favourable mortgage deals usually last for a short time. These often come in two to five-year terms, which are typically offered on discount, fixed-rate, and tracker mortgages. Once your current deal expires, your mortgage will automatically revert to your lender’s standard variable rate (SVR). Again, SVR has higher rates than other types of mortgages. To avoid the SVR, you can remortgage to a better deal, which can be a five-year fixed rate mortgage or tracker mortgage.

You want a lower interest rate.

Part of securing a better deal is obtaining a lower interest rate. Borrowers with lower LTV are usually offered the most favourable remortgaging rates. Your LTV may be lower if you’ve made qualified overpayments on your home loan. You may also have a lower LTV if your property has risen in value since you first took your mortgage.

If you obtain a much lower rate, you can reduce your monthly payments. You will also save a considerable amount on interest charges. And if you’re worried about interest rates increasing, remortgaging to a fixed-rate deal will guarantee the same rate for the agreed term.

Switch from an interest-only to a repayment mortgage.

Some lenders can change an interest-only payment to a repayment mortgage without any further processing. However, sometimes you might need to remortgage to change your payment structure. Before remortgaging, ask your current lender if they can change the payment structure directly to save time.

You want to overpay but your lender does not allow it.

Over the years, perhaps your salary has increased, or you’ve gained substantial savings. You may want to make overpayments to pay your mortgage earlier. However, your current lender might not permit it, or only accepts small overpayments. If this is the case, remortgaging allows you to switch to a lender that allows higher overpayments. You may also shorten your current mortgage term while securing a low rate. However, note that shortening your term usually results in more expensive monthly payments. Consider this carefully before remortgaging to reduce your term.

To release home equity and fund important expenses.

While people remortgage to reduce their rate, they sometimes borrow money against their home equity. Homeowners consider this option if they have built substantial home equity, and if their property has increased in value. Equity is the percentage of your home that you’ve paid off. It’s the difference between how much you owe on your mortgage and the property’s current value.

When you remortgage to release equity, you’re arranging a new deal that’s larger than your existing mortgage. The difference between your current mortgage balance and the new loan amount is the amount you will receive. For example, if you bought a home for £200,000 and your mortgage balance is £90,000, your home equity is worth £110,000. This means your LTV ratio is 45%, while your home equity is 55%. The more equity you have on your home, the higher the amount you can borrow. However, note that equity extraction impacts your interest rate. After releasing cash from home equity, expect to pay more interest.

At the time of this writing, remortgages allow borrowers to access up to 95% of their equity. But depending on the lender, other deals may only allow you to access less than 90% of your equity. Furthermore, most lenders grant remortgages with home equity releases if you use it for home renovations. Making home improvements restores value in your property. Since your house secures the mortgage, lenders find it the most reasonable use for releasing equity.

In other cases, people may remortgage to consolidate high-interest debts. Just make sure to pay off your debts as intended. If you fail to pay it back while having trouble with mortgage payments, you risk losing your home to foreclosure. Lenders also ask for proof that you used the money to pay debt. Before accessing your equity, make sure to use the money for important expenses.

When You Shouldn’t Remortgage

Though there are plenty of good reasons to remortgage, watch out for the following scenarios. Do not remortgage if you find yourself in the following situations:

1

If the early repayment cost is too expensive. High early repayment charges cancels out savings from a low rate. If it’s too expensive to get out of a current deal, it’s likely not worth the hassle. You’re better off waiting for your current deal to end before moving on to a new mortgage. It’s best to wait at least three months before your current deal expires if you intend to remortgage.

2

If your mortgage balance is already small. Once your mortgage balance falls beyond a certain amount, such as around £50,000, it’s likely not worth remortgaging with a new lender. You won’t make enough savings because of the high fees. Other lenders may no longer accept remortgages below £25,000. You’re better off staying with your current interest rate until your mortgage is paid off.

3

If your financial situation got more challenging. Perhaps you’ve gone through drastic financial challenges since you took your first mortgage. For example, your partner had to stop working for a while. Maybe you had a new baby, and your expenses are focused on your child. In other cases, a sudden economic crisis such as the COVID-19 pandemic may have put you temporarily out of work. If you’re not financially prepared, put off remortgaging for another time.

4

If you have credit issues you haven’t resolved. Since 2014, the Financial Conduct Authority (FCA) has required lenders to impose strict affordability assessments before approving mortgages. Even with a remortgage, lenders are obligated to carefully review your income and the state of your personal finances. This includes a detailed list of your outgoings, and whether you’ve paid debts on time. If you have large credit card balances or overdrafts you haven’t settled, you have lower chances of qualifying for a remortgage. Try to improve your credit before applying for a new loan.

5

If you have very little equity and your property’s value has decreased. Suppose you want to remortgage and borrow money against your equity. If you need to borrow over 90% of your home’s value, you’ll have a hard time finding a favourable rate without higher equity. Moreover, if your home’s value has dropped, you’ll likely owe a larger loan amount on your property. If this is the case, do not remortgage to tap equity. You should focus on making qualified overpayments whenever you can afford it. You want to avoid negative equity where your debt becomes much higher than your property is worth.

6

If you already have a favourable rate. It won’t make sense to remortgage if you currently have a good rate. If you’ve shopped around for new deals and didn’t find a good offer, it’s best to stay in your current deal. Generally, homeowners should shop around for a new mortgage at least three months before their current mortgage expires. Give yourself enough time, and by then, you might find a better offer.

The Remortgaging Process

Remortgaging requires similar processing and documentation just like a traditional mortgage. However, some of these steps and fees will differ. The following are steps you must take when you apply for remortgaging:

1. Obtain a mortgage agreement in principle.

Most mortgage lenders ask potential borrowers to complete a mortgage agreement in principle (AIP). This is a document that shows how much a prospective lender is willing to grant on your mortgage. An AIP does not require a specific mortgage type and is a non-obligatory document from a lender. While it does not guarantee the stated amount, it gives you a better idea how much you can borrow.

How much you can borrow for a remortgage depends on your income and personal credit background. It also depends on how much a bank or building society is willing to lend. Other factors that can affect the loan amount include loan-to-value ratio (LTV) and the current value of your property.

To estimate how much you can borrow, use our mortgage affordability calculator.

2. Are you remortgaging with the same lender or new lender?

When comparing mortgages, ask your current lender whether they’re offering new deals. Assess it with offers from new lenders. Compare the interest rate, how much they are willing to lend, and the upfront costs. Also check the new lender’s standard variable rate. In case you cannot remortgage again, you’ll have an idea how their reversion rate might rise if you can’t remortgage again in the future.

If your original lender provides a good deal, consider it. Remortgaging with your current lender is usually faster and more affordable. While it can take eight weeks to remortgage with a new lender, it can only take four weeks or less to remortgage with the same lender. Staying with your original lender lets you avoid many remortgaging fees, such as booking, arrangement, and solicitor fees. If this makes the overall package more affordable, then it’s a good deal.

On the other hand, if you find a much better deal with a new lender, don’t just focus on the interest rate. Consider all the other fees that apply. This will help you determine whether remortgaging is truly worth the cost. Once you decide to switch to a new lender, you must prepare your finances.

3. Prepare for remortgaging expenses.

Remortgages likely come with similar fees you had to pay when you first took your mortgage. It comes with costs such as arrangement fees, booking fees, valuation fees, and solicitor’s fees (also called the conveyancing fee) if you need to transfer to a different lender. Apart from possible early repayment fees to your original lender, take note of the following expenses:

- Deeds release fee – Also called an admin charge, deeds release fees are paid to your original lender to forward your title deeds to your solicitor. This is presuming you’re switching to a new lender when you remortgage. The deeds release fee is usually paid upfront when the remortgage is set, or upon closing. Not all lenders may charge this fee, but it can cost up to £300. To be sure you’re paying the right amount, check your mortgage offer and Key Facts Illustration page. The amount on your mortgage agreement should be the same. If it was not communicated to you from the start, or not specified in your mortgage agreement, your lender should not be charging it.

- Arrangement fees – Traditionally, arrangement fees are used to cover the lender’s administrative expenses. They also offset low interest rates used to attract borrowers. The amount depends on the lender and can be quite steep. Expect to be charged £1,000 or more. But as a general rule, the lower the interest rate, the greater the arrangement fee. You can pay for arrangement fees upfront or finance it into your mortgage. Financing it increases your loan amount, and you have to pay interest on it. Thus, it’s better to pay the arrangement fee upfront.

- Booking fees – To secure your new deal, you might be charged a booking fee. This can cost around £100 to £200, sometimes up to £300. It’s also called an application fee or reservation fee. Booking fees are paid upfront upon application. This is non-refundable, which means you cannot get it back if your remortgage application is declined.

- Valuation fee – Lenders request a property valuation to confirm the current value of your home. Knowing it has enough value to cover your debt makes lenders feel more confident about securing your property. Most lenders offer property valuations for free. However, some lenders may charge £300 to £400 for property valuation costs.

- Broker fee – If you’re working with a broker, they may charge you a fee. But if they are paid commission by the lender, you don’t have to pay them. Broker fees can be a fixed fee of £300. It can also be 1% of the loan amount. If your mortgage balance is £200,000, the broker fee will be £2,000, which can be costly. Try to negotiate the broker’s fee to reduce your expenses. Some brokers are flexible and might agree to lower their fee. Lastly, be cautious of brokers that charge upfront fees. You may not be refunded if your deal does not push through.

- Conveyancing fee – Conveyancing fees typically costs around £300 and is paid upfront. When you remortgage with a new lender, it entails legal work to remove the original lender from the house and register the new lender. You’ll need a solicitor to remove an old lender from the mortgage. The good news is most remortgages usually come with a legal package. However, this may be slower compared to hiring your own solicitor. But as long as your mortgage is legally worked out, it shouldn’t be a problem.

- When do you need a solicitor? If you remortgage with your current lender, by changing to a new rate or loan deal, it’s considered a product transfer. This requires no additional legal work, which means you do not need a solicitor to iron out mortgage details. In contrast, if you switch to a new lender, you’re required to get assistance from a solicitor.

4. Gather required documents & submit your application.

Once you’ve secured a mortgage agreement in principle (AIP) and considered the costs, apply for a remortgage. You must provide the necessary information about your personal and financial circumstances. Note that most mainstream lenders won’t accept printed internet statements. You must secure paper copies of documents from your bank. Prepare the required records several weeks before remortgaging. This will give you enough time to wait for your bank when your lender asks for original copies.

Sending all the required documents in one batch will help speed up the application process. This ensures only one person will review your application. If your loan is reviewed by several loan officers, it can affect your application’s approval.

Prepare the following documents for remortgaging:

- Bank statements in the last three months

- Pay slips received in the last three to six months

- Driver’s license or passport for identification

- Latest P60 tax form from your employer

- Proof of commissions or bonuses

- Proof of address such as utility bills or credit card bills

- SA203 if you’re self-employed, at least three years of accounts/tax returns

5. Complete the remortgaging process.

The process of a remortgaging is similar to a traditional mortgage. Your lender also carries out a credit check to review your financial background. They will also arrange for a property valuation. If you’re changing to a new lender, you’ll need a solicitor (conveyancer) to work out the transfer of your mortgage. Other lenders offer the solicitor’s service for free.

How long does it take to remortgage? The remortgaging process normally takes between four to eight weeks from the date of application. If you are internally remortgaging with the same lender, it can only take four weeks or less. But if you’re changing to a different lender, expect it to take up to eight weeks. Remortgage offers from lenders are usually valid for three to six months. You can set one up that’s ready as soon as your current mortgage deal ends.

How about remortgages for buy-to-let homes? Lenders consider buy-to-let mortgages as higher risk loans than residential mortgages. This is because landlords typically deal with rent collection issues. It’s also unlikely for property to be constantly occupied. Since lenders take on higher risk, buy-to-let borrowers are required to pay a larger deposit than a residential mortgage.

For buy-to-let home purchases, the minimum deposit is usually 25% of the property’s value. Meanwhile, some of the best rates for buy-to-let homes require a deposit of 40%. Likewise, a lower LTV ratio entitles a borrower to more favourable buy-to-let remortgage rates. Moreover, fees for buy-to-let remortgages are higher. For instance, the arrangement can be as high as 3.5% of the home’s price.

Residential mortgages are usually capital and interest repayment loans. In contrast, most buy-to-let mortgages are structured with interest-only payments. This means the borrower only pays monthly interest payments during the term. However, it must be paid in full by the end of the term, which entails a large cost. Most landlords pay off their buy-to-let mortgage by selling the property toward the end of the deal.

A Final Word

Remortgaging is a viable financial strategy that allows you to change to a new mortgage deal with a favourable rate. This is especially beneficial once your current introductory rate is about to end. By remortgaging, you can avoid your lender’s standard variable rate, which is usually higher than other types of mortgages. If you secure a low rate, you can take advantage of affordable payments. You’ll also increase your interest savings compared to taking an SVR. Borrowers can choose to remortgage to avoid SVR every time their current deal ends.

On the other hand, there are many things to consider if you intend to remortgage. Because it’s essentially taking a new mortgage, it entails similar requirements like a purchase mortgage. Lenders will check your credit record, income, as well as your outgoings. You must maintain a good credit score to qualify for a favourable remortgage deal. Moreover, borrowers with lower LTV ratios are typically offered the best remortgage rates.

Furthermore, you must pay a considerable amount of fees, especially if you plan to shift to a different lender. This entails expensive costs, so be financially prepared before remortgaging. Remortgaging before your current deal ends requires early repayment charges. Lenders can impose steep penalty costs, so avoid remortgaging early into a deal.

Besides obtaining a lower rate, borrowers remortgage when they want to switch from an interest-only payment into a repayment mortgage. If their current lender does not allow higher overpayments, they can remortgage to a more flexible lender. Borrowers also have the option to shorten their term, which results in higher monthly payments. But as a benefit, they pay their mortgage earlier and save tens and thousands of pounds on interest charges.

Moreover, borrowers with lower LTV, or property that has increased in value, can remortgage to release equity. They can borrow a higher amount than their original mortgage to fund important costs. Most lenders approve the funds if the money is used for home improvements. In other cases, borrowers can use the money to consolidate and pay off high-interest debts.

Before remortgaging, be sure to check offers from your current lender and other lenders. Compare the interest rate, loan amount, and upfront costs. If you find a good deal with your original lender, you can save more. You can avoid costly remortgaging expenses such as booking, arrangement, and solicitor fees. Remortgages also don’t take as long if you do it with your current lender. On the other hand, if you find a better deal with a new lender, you must budget for the remortgaging costs. At the end of the day, be sure to find a deal that can help maximise your savings.

Check Out All of Our Free Online Calculators

Widgets | Affordability | Amortisation | Overpayment | Remortgage | About

Do you have feedback or questions? Email us

© 2019 — 2025 MortgageCalculator.UK — All Rights Reserved